Lately, the media has been buzzing with concerns about an increase in property listings due to rising mortgage stress. While it’s true that housing loan arrears are on the rise, the story isn’t as alarming as it may seem.

Here’s the reality:

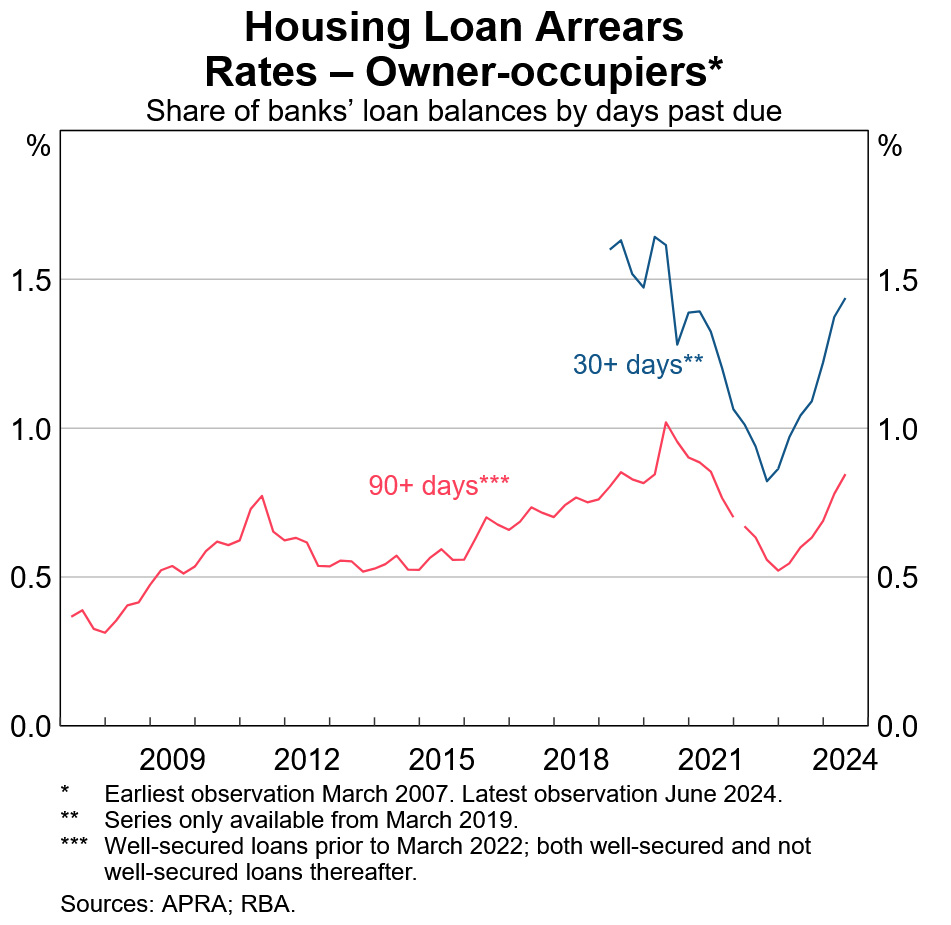

* Loan arrears are indeed increasing, but only from record lows.

* Current arrears levels are roughly where they were in 2019—before the pandemic—despite significantly higher interest rates today.

Mortgage Buffers Offer Stability

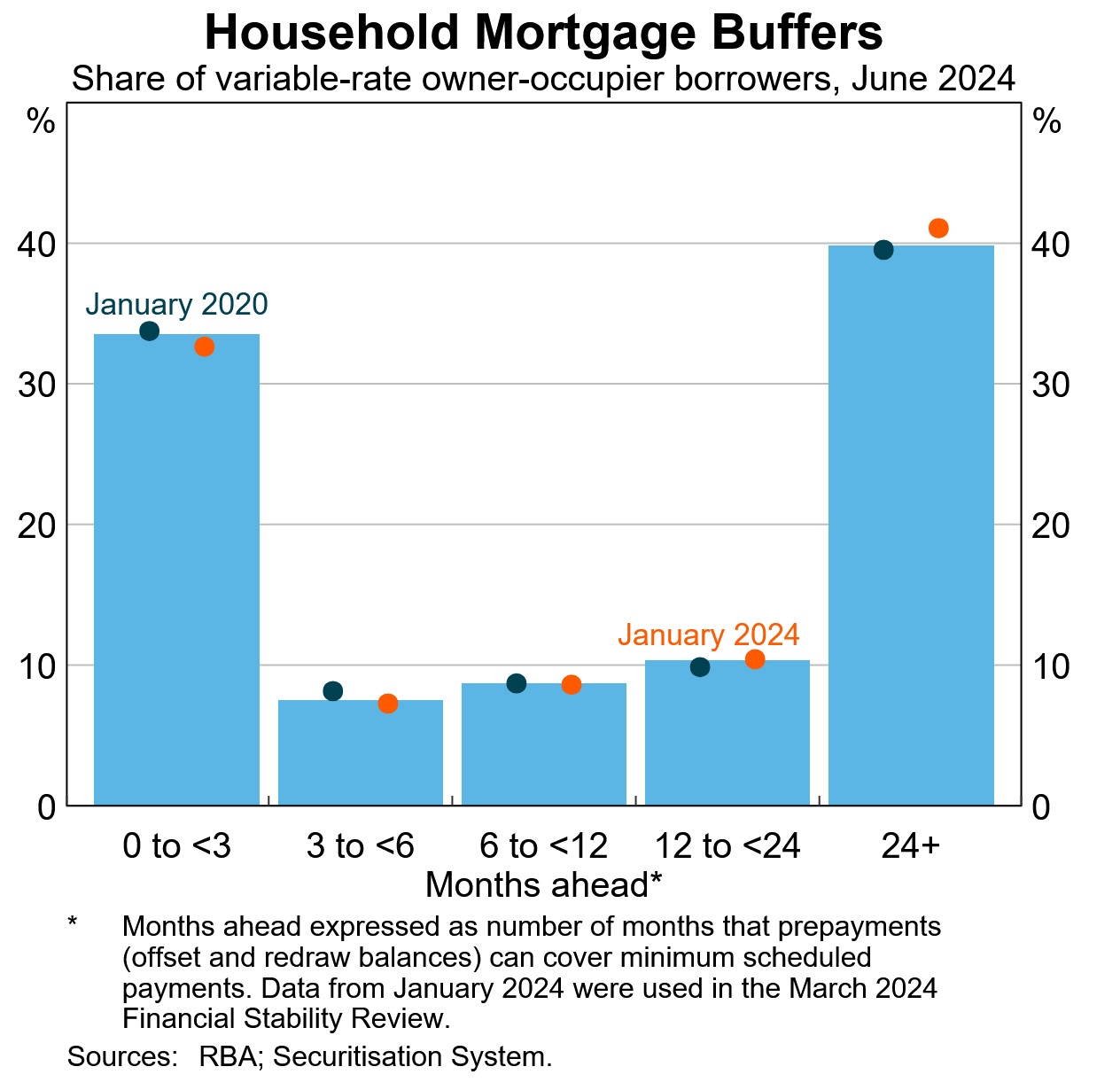

Even with rising rates, many homeowners are ahead on their mortgage repayments:

* A significant number of borrowers are 12 to 24 months ahead on repayments.

* Some are even more than two years ahead—a stronger position than in January 2020, when interest rates had already peaked for over a decade.

Distressed Sales Are Not a Crisis

On a national level, distressed property sales may fluctuate month-to-month, but they are 3% lower than this time last year. So, the idea of a market flooded with distressed sales? It’s simply not the case.

The RBA's 2025 Outlook: What It Means for You

The Reserve Bank of Australia (RBA) acknowledges the resilience of the Australian economy. However, they’ve issued a key warning:

Falling interest rates could trigger an unsustainable property price boom if households take on excessive debt in response to lower borrowing costs.

Historically, when interest rates drop, property prices soar. The RBA cautions that while a short-term boom is likely, it could lead to future risks if the market overheats.

Why Property Prices Will Likely Boom Again

Let’s break it down:

1. Australian property prices have risen for 21 consecutive months, and even with rising rates, they remain higher than in 2022 when rates were at historic lows.

2. When interest rates eventually fall, buyer affordability will improve, and current mortgage holders will feel less financial pressure.

3. With improved affordability, demand will increase, driving property prices higher—potentially steeply.

What to Expect in 2025

We anticipate the following market trends:

* Sharp property price increases once interest rates are cut, likely starting around February 2025.

* A period of rapid price growth, followed by a slower, more sustainable rate of increase over time.

* Property prices continuing to rise beyond inflation, even as the pace of growth moderates.

Why Now is the Time to Buy

At First National Real Estate Bundaberg, we see the current market as a prime buying opportunity. Purchasing now or before February positions you to:

* Capitalise on expected price increases once interest rates drop.

* Build equity quickly as your property value rises.

* Set yourself up for future financial success with a property asset poised for growth.

Final Thoughts

Yes, property prices may rise steeply in 2025, and some may worry about sustainability. However, the fundamentals of the market remain strong. By purchasing now, you can ride the wave of rising property values and position yourself ahead of the curve.

Thinking about buying? Let’s chat about how you can make the most of this market opportunity. Contact First National Real Estate Bundaberg today!