The real estate market in Bundaberg, has experienced dynamic changes in 2024, showing promising growth across multiple suburbs. Whether you're a property owner, investor, or someone looking to understand the trends before making a move, this guide offers a comprehensive analysis of house prices, unit prices, and rental yields over the last three months (June, July, and August 2024).

We’ll explore how different suburbs performed, highlight the top growth areas, and offer insights for both property owners and investors. So, let’s dive in!

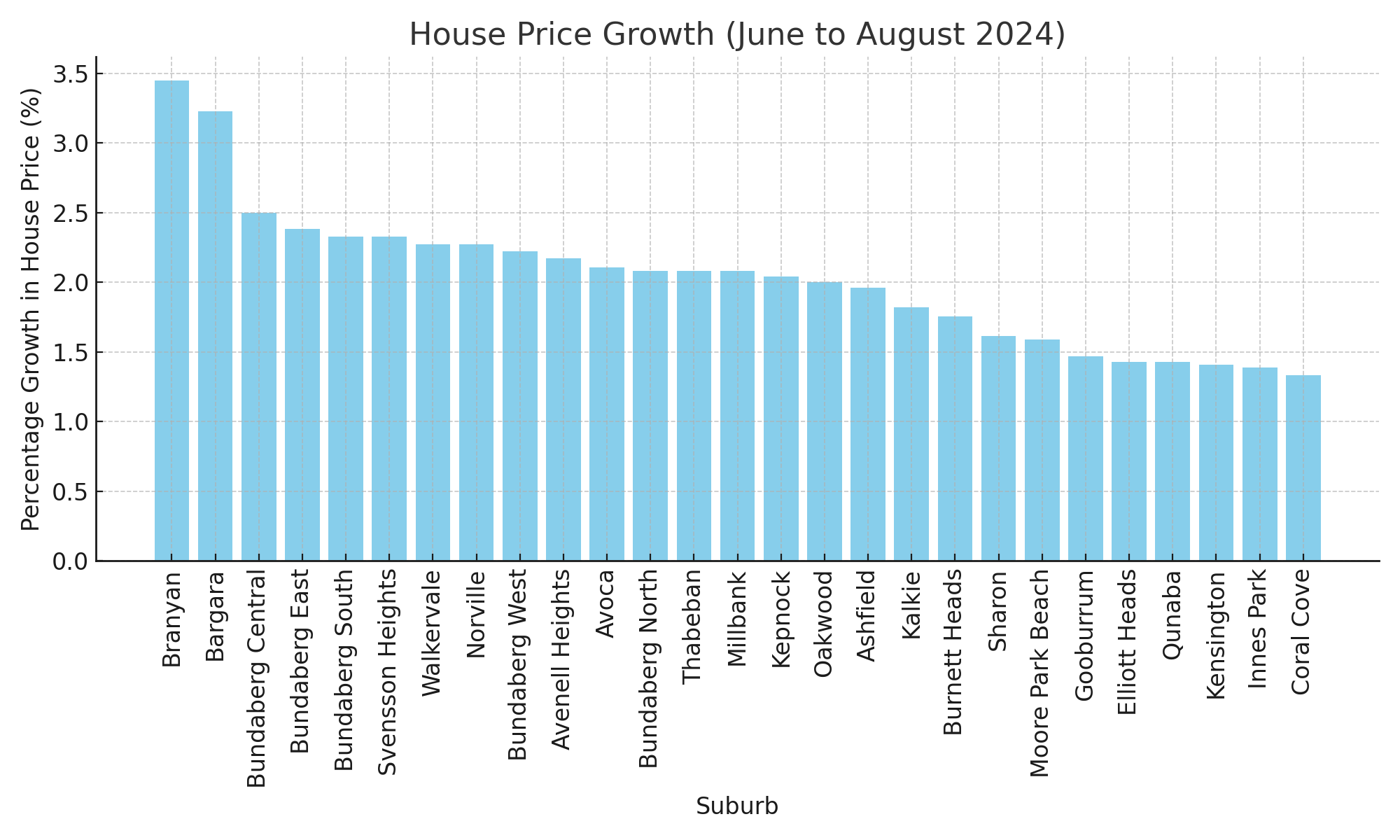

House Price Growth: Winners and Losers

Overview: The Top Performers

The house market in Bundaberg has been flourishing, with the average suburb showing a 2.3% growth in median house prices over the last three months. Here are the standout performers:

1. Branyan led the growth with a 3.45% increase, making it the hottest suburb for property appreciation.

2. Bargara wasn't far behind, recording a 3.23% growth rate.

3. Bundaberg Central, despite being one of the more established suburbs, saw a solid 2.5% increase.

Key Insight: These growth trends suggest that Branyan and Bargara are emerging as top contenders for capital appreciation, making them prime targets for property investment.

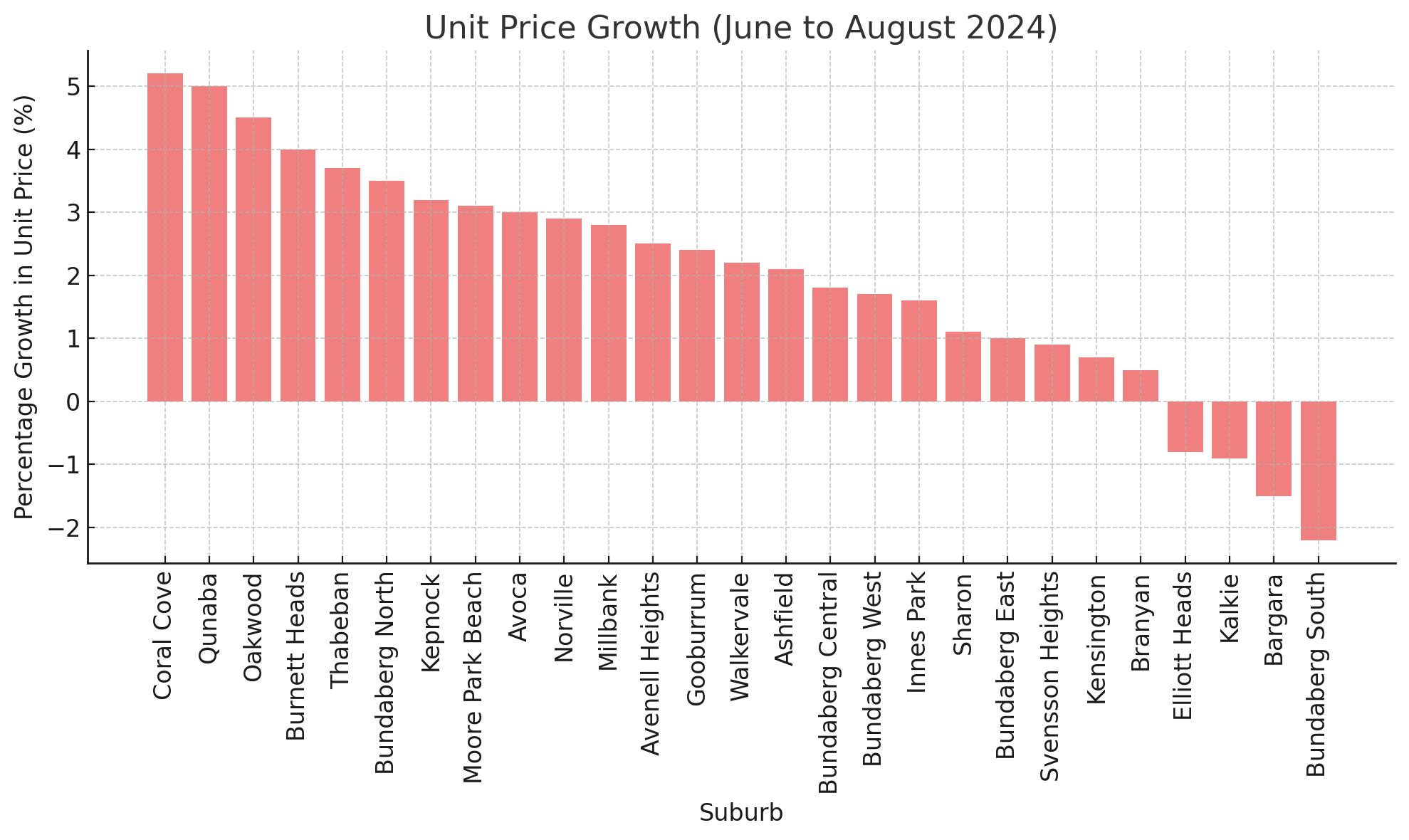

Unit Price Growth: The Unexpected Climbers

Overview: The Surprise Performers

The unit market saw some interesting shifts, with certain suburbs experiencing substantial growth:

1. Coral Cove saw a 5.2% increase in unit prices, leading the charge.

2. Qunaba followed closely, with a 5.0% increase, making it an area to watch.

3. Oakwood also showed resilience with a 4.5% growth, despite not being as well-known as the other high-performers.

Key Insight: Coral Cove's exceptional growth indicates a rising demand for units, making it a potential hotspot for unit investments.

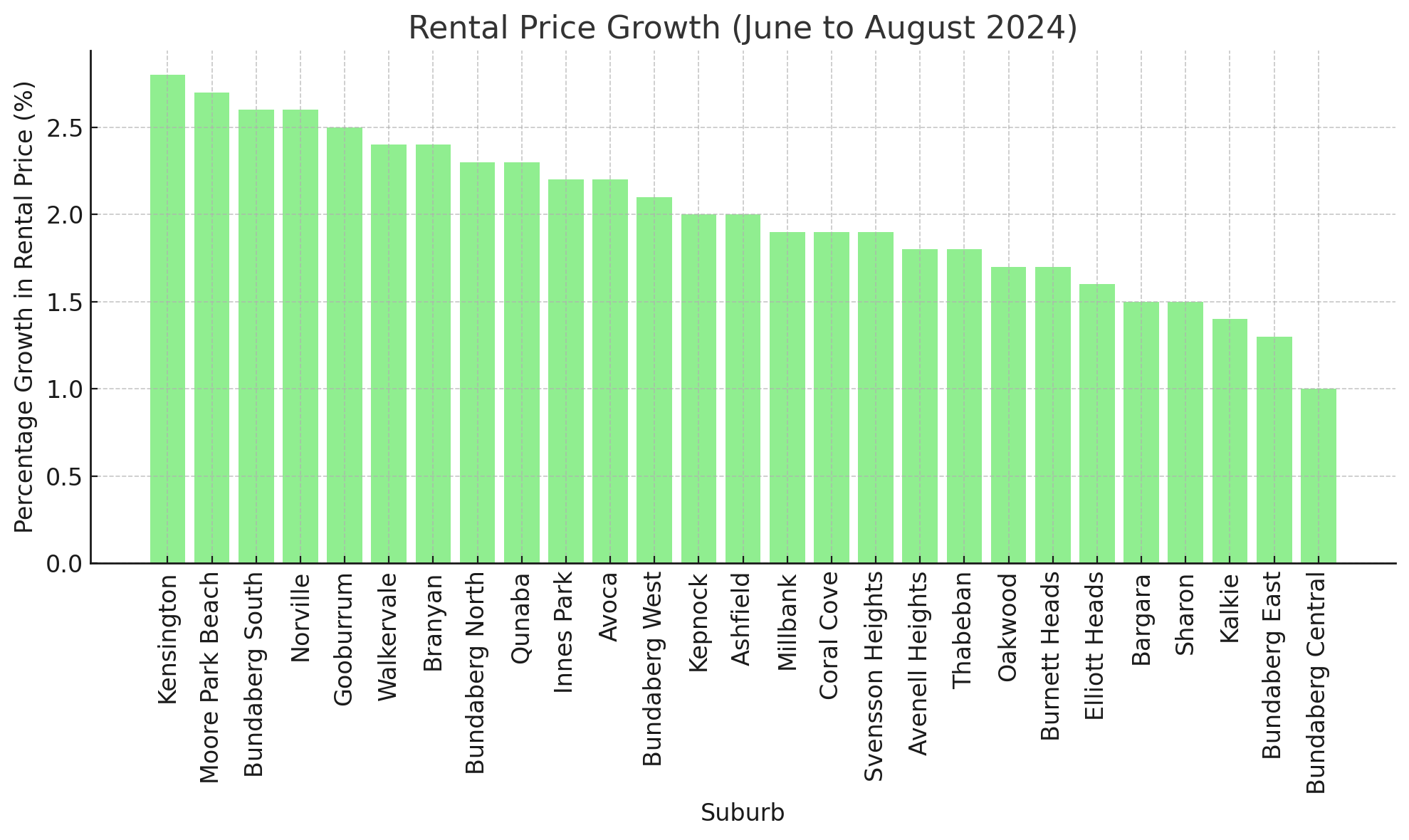

Rental Price Growth: Maximising Investment Returns

Rental yields provide another perspective on the real estate market's health. Suburbs with strong rental price growth can be particularly attractive to investors focused on generating consistent cash flow.

Top Performers in Rental Price Growth

1. Kensington stood out with a 2.8% increase in rental prices, making it a top choice for rental income.

2. Moore Park Beach and Norville followed closely, each showing a 2.7% growth in rental yields.

3. Other strong contenders include Branyan and Walkervale, making them appealing for investors targeting rental returns.

What This Means for Property Owners and Investors

For Property Owners:

Capital Appreciation: If you own property in high-growth suburbs like Branyan or Bargara, now might be a great time to consider selling or refinancing to capitalise on your asset's appreciation.

Potential Upgrades: Suburbs with slower growth but stable rental yields, such as Bundaberg East and Burnett Heads, might benefit from property upgrades to attract higher-paying tenants or increase your property's value.

For Property Investors:

High Rental Yields: Bundaberg Central offers the highest rental yield at 6.5%, making it an ideal suburb for cash-flow-focused investments.

Emerging Opportunities: Coral Cove and Qunaba present significant opportunities for unit investments due to their impressive growth trends, making them attractive for both short-term gains and long-term appreciation.

Stable Returns: Suburbs like Svensson Heights and Thabeban provide consistent rental yields, making them suitable for investors seeking steady, low-risk returns.

Final Thoughts: Navigating Bundaberg's Real Estate Market

The Bundaberg real estate market is showing promising signs of growth, with several suburbs emerging as clear winners in terms of capital appreciation and rental income potential. Whether you're looking to invest, sell, or hold onto your property, understanding these trends is crucial for maximising your returns.

Next Steps:

Monitor High-Growth Suburbs: Keep an eye on Branyan, Bargara, and Coral Cove for both house and unit investment opportunities.

Explore Rental Markets: Consider investing in suburbs with high rental yields, such as Bundaberg Central and Kensington.

By staying informed about these trends, property owners and investors can make strategic decisions that align with their financial goals.

Looking for how your suburb performed?

Download our detailed report here

-

about 22 hours agoHow did the Bundaberg Property Market perform in 2024?

-

5 days agoBanks Revise Interest Rate Cut Forecast

-

15 days agoAustralia's Housing Crunch: Perth and Regional Queensland Hit Hard

Click to enlarge

Click to enlarge Click to enlarge

Click to enlarge